Coal

Coal Our core operation is thermal, semi-soft coking and metallurgical coal mining, supplying Eskom, other domestic markets and offshore markets. Our coal mining business (including Reductants) is structured under five legal entities, all managed and operated by Exxaro, supplemented by a joint venture for the Mafube operation and an equity interest in Richards Bay Coal Terminal Proprietary Limited (RBCT).

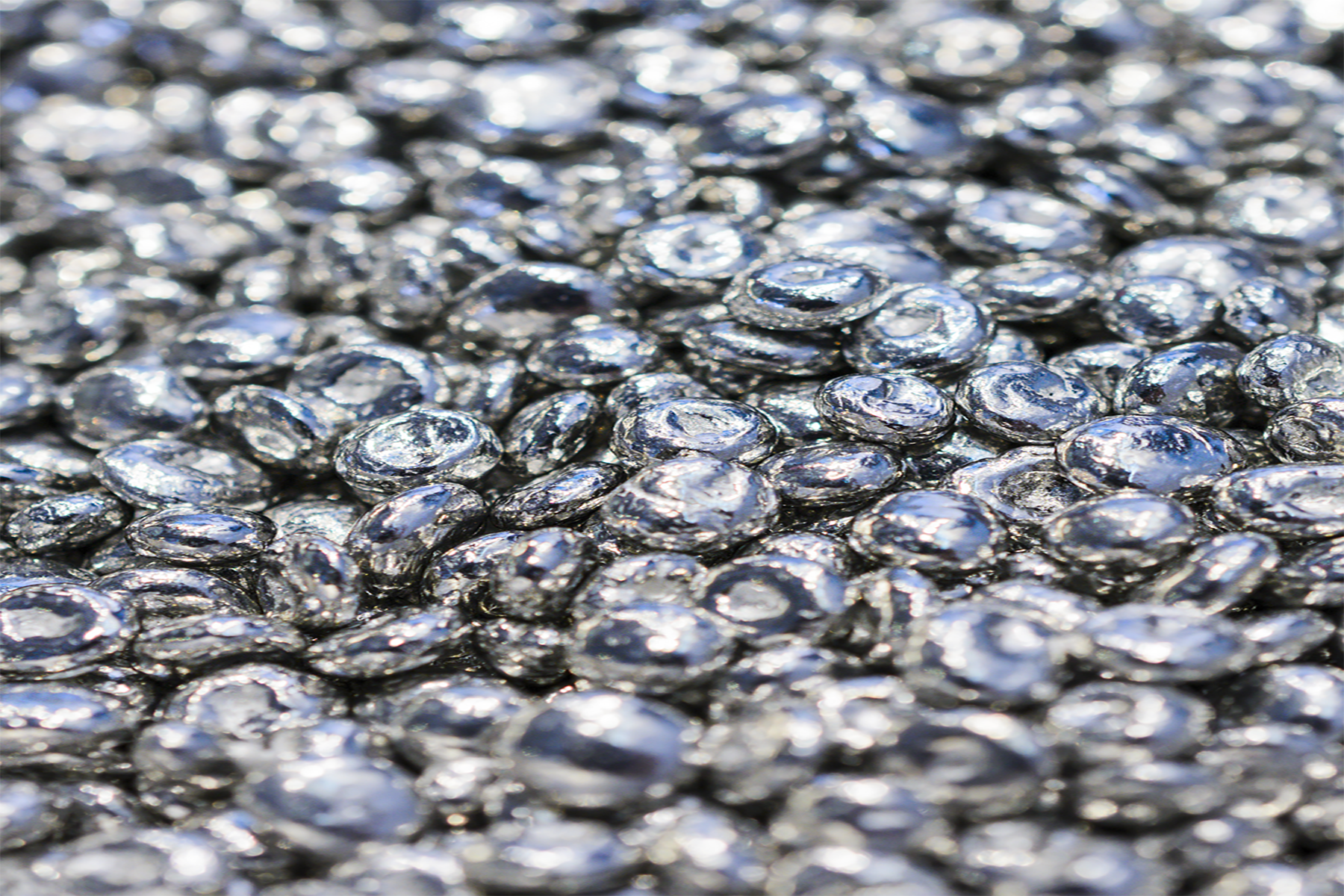

Iron Ore

Exxaro owns 21% of Sishen Iron Ore Company (SIOC). They are a leading supplier of high-quality iron ore to the global steel industry and a subsidiary of Kumba Iron Ore Limited (KIO).

Zinc

26% equity interest: Black Mountain Black Mountain operates two underground mines and a processing plant in the Northern Cape producing zinc and other minerals We continue evaluating our options to dispose of our shareholding in Black Mountain following the suspension of the sale in December 2020.

Renewable Energy

CENNERGI

Our investments in renewable energy are a core pillar of our business resilience. We have been deliberate in building our capabilities in renewable energy through our investment in Cennergi, which we acquired full ownership of in April 2020. Scaling our renewable energy business allows us to build on our position as a key anchor of energy security in South Africa, a significant contributor to renewable energy solutions and decarbonisation. Our renewable energy business consists of 239MW of wind generation assets in the Eastern Cape that contribute to national power grid.